7 Multifamily Real Estate Trends Smart Investors Are Watching for 2025

Multifamily real estate investors face a dramatically different market heading into 2025. While some experts predict a market slowdown, savvy investors are discovering new opportunities in this evolving landscape.

The past year has reshaped traditional investment strategies, with rising interest rates, shifting demographics, and technological advances transforming the real estate investing landscape. However, data shows that multifamily investing continues to offer strong returns for those who know where to look.

From emerging Sun Belt markets to innovative financing solutions, these seven critical trends will shape successful multifamily investments in 2025. Understanding these shifts now could mean the difference between thriving and merely surviving in tomorrow's market.

Rising Interest Rate Impact on Multifamily Investment

Image Source: CRE Daily

Interest rates remain a pivotal factor shaping multifamily real estate investments as we approach 2025. The Federal Reserve's monetary policy decisions continue to influence market dynamics significantly.

Interest Rate Trends and Forecasts

The federal funds rate currently sits between 4.25% and 4.5%, marking a decrease from the 5.25%-5.5% range maintained throughout most of 2023. Specifically, Moody's Analytics projects the federal funds rate to settle around 4% by the end of 2025. Furthermore, the 10-year Treasury yield, a crucial benchmark for multifamily loans, has demonstrated notable volatility, fluctuating between 3.75% and 4.5%.

Impact on Cap Rates and Valuations

Property valuations have experienced significant pressure due to the interest rate environment. Accordingly, multifamily property prices have declined for nine consecutive quarters since mid-2022, showing a total decrease of nearly 20%. The relationship between cap rates and interest rates presents a complex dynamic:

Cap rates have remained relatively stable, operating within a 5.6% to 5.7% range

The cap rate spread sits at approximately 170 basis points, notably below the historic average of 300 basis points

Investment Strategy Adjustments

Consequently, investors are adapting their approaches to navigate this evolving landscape. The multifamily loan origination volume is expected to increase to $320 billion in 2024 and reach $370-380 billion in 2025. Investment strategies now emphasize:

Strategy Component

Focus Area

Asset Selection

Properties with strong fundamentals and stable cash flows

Financing

Creative structures and alternative funding sources

Risk Management

Enhanced due diligence and operational efficiency

The window between interest rate adjustments and cap rate responses, typically six to nine months, creates strategic opportunities for well-positioned investors.

Supply-Demand Dynamics Shift

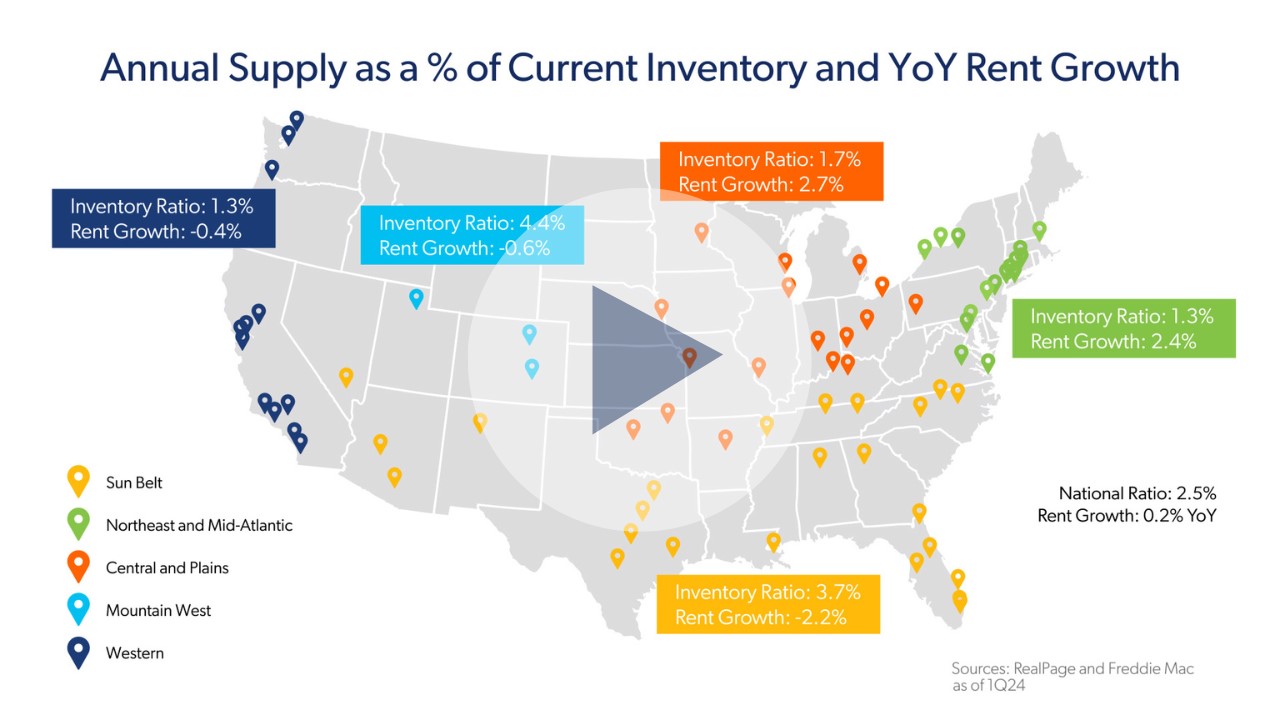

Image Source: Freddie Mac Multifamily

The multifamily real estate landscape is experiencing an unprecedented supply surge, with a record-breaking 554,000 units projected for completion.

New Supply Pipeline Analysis

The construction pipeline remains substantial, with over 900,000 units underway across the U.S. Indeed, the development activity has reached its highest level since the 1980s. Moreover, Yardi Matrix forecasts indicate an 8.1% increase in supply for 2025, projecting 508,089 units.

Absorption Rate Predictions

Despite initial concerns, absorption rates have demonstrated remarkable resilience. The market absorbed 667,000 units in 2024, notably exceeding expectations. The absorption trends vary across regions:

Northeast and Midwest markets maintain stable occupancy rates of 96.3% and 95.3% respectively

Southern regions show lower occupancy at 93.9%

Market-Specific Supply Impacts

Regional market performance presents striking contrasts. Here's how key markets are responding to supply changes:

Market

Supply Impact

Current Status

Austin

Decreased from 19% to 11% of inventory

Supply stabilizing

Nashville

Reduced from 15% to under 9%

Pipeline shrinking

San Jose

3.5 years of construction remaining

Higher risk profile

The Sun Belt and Mountain West regions face the most significant supply pressure. Additionally, markets like Phoenix, Tampa, and Nashville are experiencing what analysts term a "hangover effect" from post-pandemic growth.

Looking ahead, the construction pipeline is expected to decrease substantially, with new development starts dropping by approximately 50% from 2022-2023 levels. This reduction in future supply suggests a more balanced market environment by 2026.

ESG and Sustainability Focus

Image Source: Spark Investment Group

Sustainability has emerged as a crucial factor driving multifamily real estate investment decisions. The sustainable construction sector is projected to grow at 8.91% annually, reflecting the increasing emphasis on environmental responsibility in property development.

Green Building Requirements

Property developers are adapting to stricter carbon emissions regulations and growing demand for eco-friendly features. In fact, 83% of residents believe living in a sustainable building benefits their health, with 59% willing to pay premium rents for green properties. Key requirements now include:

Biophilic design integration for improved air quality

Water conservation systems

Low-VOC materials for healthier living environments

Electric vehicle charging infrastructure

Energy Efficiency Investments

Energy efficiency remains fundamental to sustainable multifamily properties. Buildings currently contribute 34% of global energy demand, making efficiency improvements particularly valuable. The following table illustrates key investment areas and their benefits:

Investment Area

Primary Benefits

LED Lighting & Sensors

Energy savings, reduced maintenance

Smart Thermostats

Precise temperature control

Enhanced Insulation

Improved energy efficiency

Solar Panel Integration

Reduced carbon footprint

ESG Reporting Standards

As of 2021, over 22,200 REITs now publish ESG data publicly, notably up from just 60 in 2017. The Global Real Estate Sustainability Benchmark (GRESB) has become the primary framework for evaluating environmental performance. Above all, properties with strong ESG scores demonstrate:

26% lower insurance cost increases

Enhanced asset value preservation

Improved access to green financing programs

Better compliance with evolving regulations

In essence, multifamily properties implementing comprehensive ESG strategies are experiencing tangible benefits, as buildings with sustainable features are increasingly viewed as more viable long-term investments.

Regional Market Performance Divergence

Image Source: CBRE

Market performance across U.S. regions shows striking contrasts as we enter 2025. Rather than following uniform patterns, multifamily real estate markets are demonstrating unprecedented divergence in growth and stability.

Sun Belt Market Analysis

The Sun Belt continues to attract significant population growth, with Las Vegas, Austin, Phoenix, Raleigh/Durham, and Orlando projecting growth rates between 10% to 7.2% through 2029. Nevertheless, these markets face challenges from substantial new supply, notably in Salt Lake City, Nashville, Charlotte, Austin, and Raleigh/Durham, where supply ratios exceed 6.2%.

Coastal Gateway Performance

East and West Coast markets present contrasting scenarios:

Region

Rent Growth

Occupancy Trend

East Coast

+2% or higher

Stable to improving

West Coast

-2.3% to -2.5%

Declining

Newark leads rent growth among major markets at 4.3%, with Boston following at 3.1%. Generally, West Coast gateway markets struggle, with San Jose (-2.5%), Oakland (-2.4%), and San Francisco (-2.3%) experiencing notable declines.

Secondary Market Opportunities

Secondary markets are emerging as attractive investment destinations, offering several advantages:

Lower construction costs and entry points

Strong demand from population shifts

Reduced competition compared to primary markets

The Midwest and Northeast regions demonstrate particular strength, with annual rent growth of 2.7% and 2.4% respectively. Overall, markets with lower supply levels, especially smaller secondary and tertiary locations in the Sun Belt, along with larger coastal markets, are positioned for stronger performance in 2025.

Technology Integration and Smart Buildings

Image Source: creti.org

Smart technology integration is rapidly reshaping multifamily real estate operations, with the U.S. smart home market projected to reach $38.80 billion in 2024.

PropTech Adoption Trends

Initially, property managers are prioritizing technologies that enhance operational efficiency. Currently, 24% of multifamily owners and operators report having smart building providers for at least one property. Notably, over half of high-income renters consider smart home technology essential, with 51% viewing it as a must-have amenity.

Smart Building Features

The most impactful smart building technologies include:

Smart thermostats reducing annual utility costs by 30%

Water leak detection systems cutting damage repair costs by 70-90%

Smart locks boosting maintenance staff efficiency by 20%

Smart access control systems for remote property management

Technology ROI Analysis

The financial benefits of smart building implementation are markedly evident:

Investment Area

Return Metrics

Energy Management

18-20% cost savings in common areas

Insurance Costs

Up to 10% reduction in annual premiums

Rental Premium

$37.65 average increase per unit

Property Value

3-5% potential increase

Simultaneously, property managers report a 10-15% increase in lease closure rates through self-guided tours. Smart building solutions simultaneously reduce operational costs and enhance resident satisfaction, with 39% of multidwelling unit residents considering property-provided smart devices a key differentiator.

Evolving Renter Demographics

Image Source: Spark Investment Group

Demographic shifts are reshaping the multifamily real estate landscape as Generation Z emerges as a dominant force in the rental market. Currently, Gen Z accounts for 25% of all renters, representing the second-largest renter demographic after millennials.

Gen Z Renter Preferences

The rental market is witnessing a notable transformation as Gen Z comprises 47% of recent renters. Evidently, this generation faces unique financial challenges, with 73% reporting difficulties in saving money. Their preferences differ from previous generations in several ways:

64% express strong interest in homeownership if mortgage rates decrease

95% prioritize staying within their initial budget

One in three believe homeownership may be financially unattainable

Remote Work Impact

The integration of work-from-home considerations has become fundamental in multifamily design. Notably, 53% of workers operate in hybrid settings, with projections suggesting up to 36 million Americans could work remotely by 2025. Property designs now incorporate:

Design Element

Purpose

Open Floor Plans

Flexibility for home office setup

Dedicated Office Spaces

Support for remote work

Enhanced Sound Proofing

Privacy for video calls

Amenity Demands

Certainly, amenity preferences have evolved to support modern lifestyle needs. Properties are adapting by offering WeWork-style coworking areas with diverse seating options and natural light. Likewise, developers report that high-speed internet access has become the most crucial amenity, with additional emphasis on:

Collaborative zones with adjacent pantries

Private conferencing spaces

Property-wide internet connectivity

Flexible communal workspaces

The shift in renter demographics continues to influence multifamily real estate development, with properties adapting to accommodate both living and working requirements under one roof.

Alternative Financing Solutions

Image Source: J.P. Morgan

Financing options for multifamily real estate are undergoing substantial transformation as alternative lenders gain prominence. Currently, these non-traditional sources account for 33% of Q2 commercial and multifamily loan volume.

Creative Financing Structures

Alternative financing solutions have notably expanded beyond conventional bank loans. Private lenders are stepping in where banks that previously offered 75% loan-to-cost ratios now only provide approximately 55%. The market offers several innovative options:

Seller financing for direct property payments

Hard money loans for quick closings

Bridge loans for short-term needs

Mezzanine debt for gap financing

Agency Lending Programs

The Federal Housing Finance Agency has primarily strengthened its support for multifamily lending. For 2025, each government-sponsored enterprise (Fannie Mae and Freddie Mac) will receive a loan purchase cap of $73 billion. Subsequently, this represents a 4% increase from 2024 levels.

Private Capital Sources

Family offices and debt funds are increasingly filling the void left by traditional banks. Consider the current lending landscape:

Lender Type

Market Share

Alternative Sources

33%

Banks

30%

Insurance Companies

30%

CMBS

7%

Alternatively, programs like Amazon Housing Equity Fund demonstrate innovative approaches, having deployed $2 billion in low-interest loans for creating 20,000 units. The fund recently announced an additional $1.4 billion commitment for 20-year loans at below-market rates.

Conclusion

Smart multifamily real estate investors recognize 2025 brings both challenges and opportunities. Rising interest rates have reshaped investment strategies, though cap rates remain relatively stable between 5.6% and 5.7%. Supply pressures vary significantly across regions, with Sun Belt markets facing the greatest impact from new construction.

Sustainability stands out as a key driver of property values, demonstrated by the 83% of residents who believe green buildings benefit their health. Regional performance shows striking contrasts - Northeast and Midwest markets maintain strong occupancy rates above 95%, while Southern regions hover around 94%.

Technology adoption continues reshaping property operations, delivering measurable returns through smart building features that cut utility costs by up to 30%. Generation Z now represents 25% of all renters, demanding flexible spaces that accommodate remote work. Alternative financing solutions have gained prominence, accounting for 33% of recent loan volume as traditional lending tightens.

Successful multifamily investors will need adaptable strategies focused on:

Properties with strong fundamentals in supply-constrained markets

Smart technology integration for operational efficiency

ESG initiatives that attract sustainability-minded renters

Creative financing approaches beyond traditional bank loans

These market shifts create distinct advantages for investors who understand emerging trends and position their portfolios accordingly. Rather than viewing market changes as obstacles, forward-thinking investors see opportunities to acquire and optimize properties aligned with evolving renter preferences and market dynamics.

Ready to Take Control of Your Retirement?

Don’t leave your future up to chance. Multi-family real estate can provide the consistent income and wealth-building opportunities you need to retire on your terms.

👉 Click here to stay informed about multi-family strategies, or sign up here to be notified about upcoming investment opportunities.

Let’s start building a future you can count on! 💼💰